Double Entry for Dividend

It took nearly seven centuries for the population to double from 025 billion in the early 9th century to 05 billion in the middle of the 16th century. He has worked as an accountant and consultant for more than 25 years and.

Journal Entries Examples Format How To Explanation

No other investment services provide you.

. Thats a consistent return which means using the rule of 72 I double my portfolio every 6 years. Which one of the following is not necessary in order for a corporation to pay a cash dividend. Journal entries are the foundation for all other financial reports.

Because shareholders are a companys owners they reap the benefits of. When a corporation earns a profit or surplus it is able to pay a proportion of the profit as a dividend to shareholders. Furthermore the number of transactions entered as the debits must be equivalent to that of the credits.

For individuals or companies with relatively small investments in other companies the dividend payout is treated as income. Dividend received from a foreign company gets taxed both in India and in the home country of the foreign company. Short Interest 437M 081522 of Float Shorted 186.

A dividend is a distribution of profits by a corporation to its shareholders. So when you buy goods it increases both the inventory as well as the accounts payable accounts. Double-entry bookkeeping also known as double-entry accounting is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information.

An entry may be required if it is a stock dividend. Get Ready once again its time to Double Your Dividend and you can win with the KSRM Radio Group. As per this section 10 TDS is applicable for dividend income above Rs5000 for an individual.

The recipient records this transaction when it gains the rights to the payout. Double entry bookkeeping Double Entry Bookkeeping Double Entry Accounting System is an accounting approach which states that each every business transaction is recorded in at least 2 accounts ie a Debit a Credit. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

The credit entry to dividends payable represents a balance sheet liability. You buy 1000 of goods with the intention of later selling them to a third party. It describes the drop of a stock or index a rebound another drop to the same or similar level as the original.

As the growth rate slowly climbed the population doubling time fell but remained in the order of centuries into the first half of the 20th century. Many of the first companies to be part of the stock market used to pay large double-digit dividends to their shareholders. Examples of Double Entry Accounting.

Every entry to an account requires a corresponding and opposite entry to a different account. This rate will be increased to 20 in the absence of PAN submission by the recipient of dividend income. The entry is a debit to the inventory asset account and a credit to the cash asset account.

The entry box will be at sponsor stores each day starting at 10am. Any amount not distributed is taken to be re-invested in the business called retained earningsThe current year profit as well as the retained earnings of previous years are. A double bottom is a charting pattern used in technical analysis.

Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income signed at Sydney on August 6 1982. A shareholder is any person company or other institution that owns at least one share of a companys stock. Arista Networks double downgraded to underperform from buy at BofA Securities.

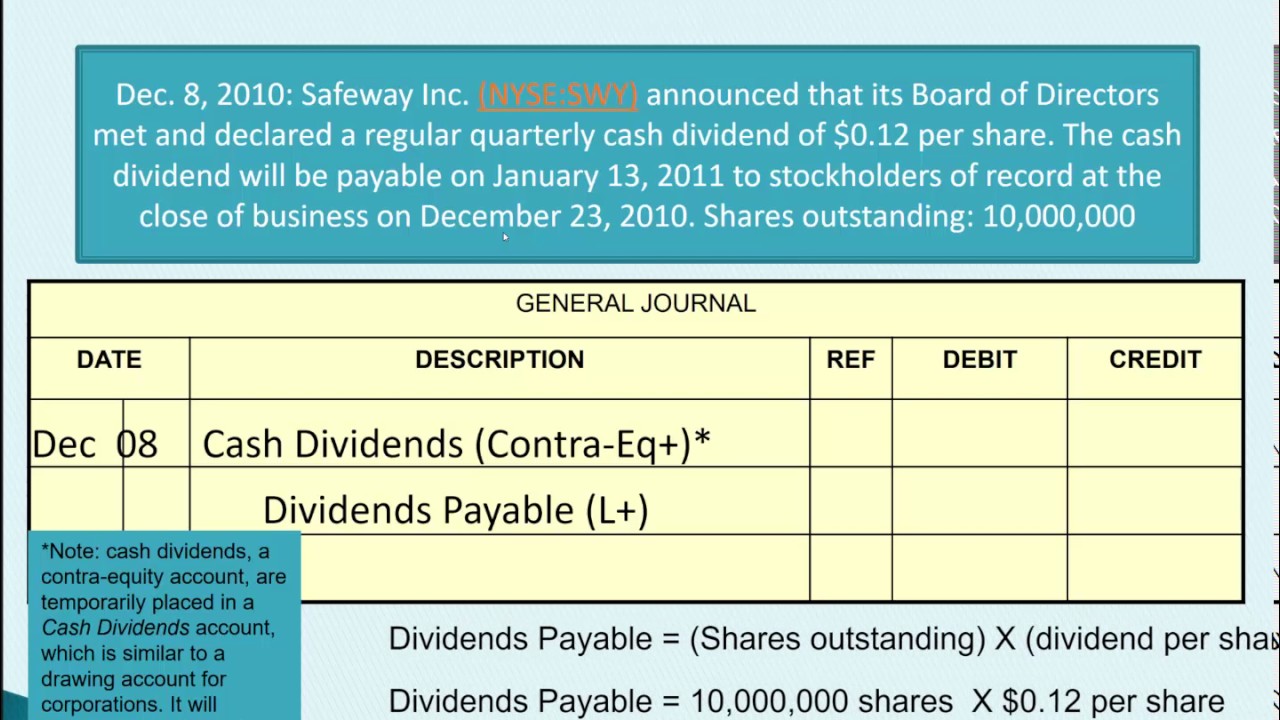

At the date of declaration the business now has a liability to the shareholders to be settled at a later date. Ex-Dividend Date NA. 30 Founded in 1895 South Africa-based DRDGold DRD 1172 is a mining company that focuses on gold tailings businesses in the regionTailings are.

Dividend paid by a resident company of a contracting state to a resident of the other contracting state may be taxed in that other state. At the same time as the dividend is declared the business will have decided on the date the dividend will be paid the dividend payment date. Listen for the location of the day Monday through Saturday on KSRM 920AM KWHQ 1001 FM KKIS 965 FM KSLD 1140AM KFSE 1069FM and KKNI 1053 FM then go and register.

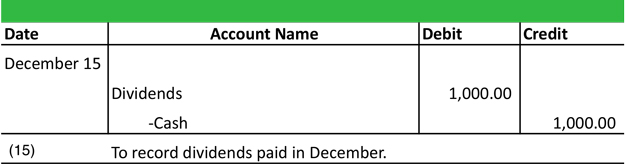

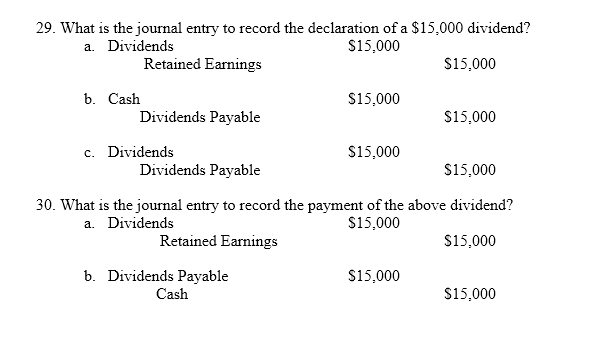

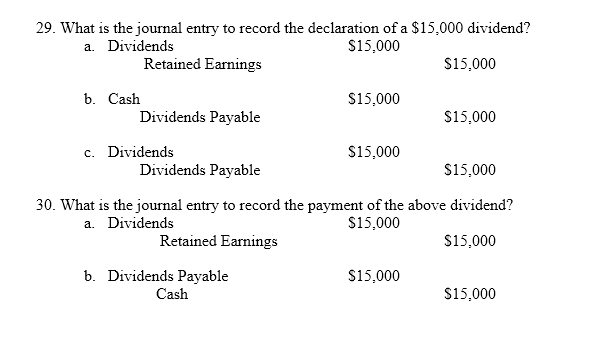

With a dividend yield well above 45 at this writing and six decades of annual payout growth theres a lot for dividend investors to like about Walgreens stock. Used in a double-entry accounting system journal entries require both a debit and a credit to complete each entry. Movement on the Retained Earnings Account.

In the past the population grew slowly. To determine the accounting treatment of preference shares and dividend on such shares first you have to identify if preference shares are redeemable or irredeemable. Article 28 -----Entry into Force Article 29 -----Termination Letter of Submittal-----of 17 August 1982 Letter of Transmittal-----of 14 September 1982 The Saving Clause-----Paragraph 3 of Article 1.

10 billion Dividend yield. They provide important information that are used by auditors to. My approach is simple but you need key data that I have cultivated with the Dividend Snapshot Screeners.

A Adequate cash b Retained earnings. Here are the double entry accounting entries associated with a variety of business transactions. Actual miles driven each year were 40000 miles in year 1 and 46000 miles in year.

Where DEA represents Dividend Expenses Assets for Debit increases and. Accounting treatment for redeemable preference shares If preference shares are redeemable then shares are reported as liability in statement of financial position. I also transmit.

Over time the market financial advisors and the 247 news cycle got. Relief from Double Taxation. Technically you can consider the below as the best TSX dividend stocks now for an entry point.

After the closing journal entry the balance on the dividend account is zero and the retained earnings account has been reduced by 200. C no entry is required. The company receiving the payment books a debit to the dividends receivable account and a credit to the dividend income account for the payout.

This is an interesting fact that although they. If a US Company pays a dividend to an Indian Resident shareholder then the dividend income will be liable to tax in India.

Dividends Declared Journal Entry Double Entry Bookkeeping

Solved 29 What Is The Journal Entry To Record The Chegg Com

Dividends Payable Classification And Journal Entry Debit Credit

Calculating Dividends Recording Journal Entries Youtube

0 Response to "Double Entry for Dividend"

Post a Comment